//php echo do_shortcode(‘[responsivevoice_button voice=”US English Male” buttontext=”Listen to Post”]’) ?>

Chip designers Ethernovia and Marvell aim to simplify the jumble of cables connecting brakes, infotainment and driver-assistance systems with new silicon for Ethernet in cars, one of the last domains where wired local area networks are expanding as automobiles become computers on wheels.

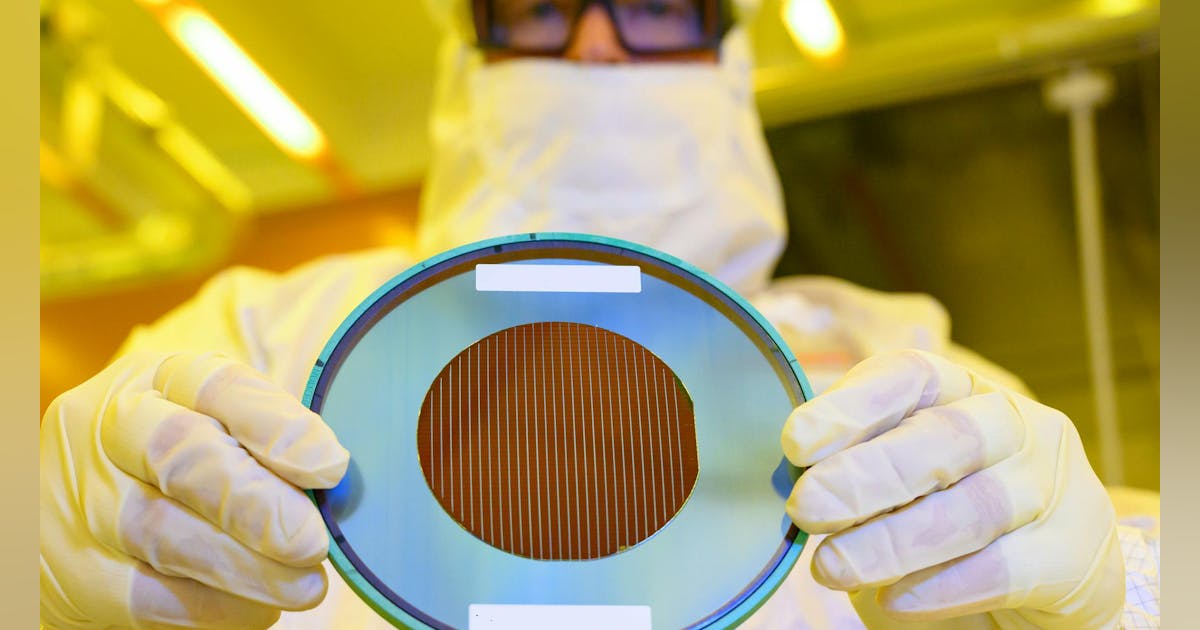

Startup Ethernovia is sampling physical-layer transceivers that scale from 10 Gbps to 1 Gbps over 15 meters of automotive cabling. The company is making the chips in 7-nm design rules at Taiwan Semiconductor Manufacturing Co. (TSMC), which Ethernovia claims provides a first-mover advantage at that leading-edge node. The company expects to start volume production of the chips within a few years.

Ethernovia and Marvell expect their chips to help eliminate the dense, hand-assembled wiring harnesses in cars today. The harnesses connect a domain-based architecture, under which car OEMs like General Motors or Toyota have teams working independently on areas like chassis control, infotainment or ADAS. Each colored cable in a wiring harness represents a different bus technology, such as CAN, LIN or FlexRay.

“The way a traditional OEM works is they do not replace stuff they’ve done in the past,” Ethernovia business development VP Chris Mash told EE Times. “They just lay a few things on top. They don’t throw the whole architecture out between generations. They innovate where they can and potentially reuse seat actuators or window actuation from the previous generations. That’s led to this layering of technology.”

The chip designers expect their zonal architectures to replace domain-based networks.

“The paradigm for years has been one vehicle function—one electronic control unit [ECU],” said Ian Riches, VP of automotive practice at TechInsights. “This has led to a situation where a car can easily now have more than 150 of these separate controllers. Adding each of these new controllers at a time makes sense—after all, N + 1 is very close to N. However, there’s a point where the value of N starts to be a problem in terms of managing the logical complexity of the network, as well as the physical complexity and weight of the wiring harness and the physical space required to fit in all these control units.”

Going to a more centralized architecture, with functions integrated into a smaller number of larger, more powerful compute platforms connected via Ethernet, is a potentially huge benefit, Riches added.

“It has been talked about, and implementation started years before ‘software-defined vehicle’ became the buzz phrase that it is today,” he said. “Architecture change and automotive Ethernet play into the software-defined story, but they go much wider and deeper.”

The latest generation of cars, whether they’re autonomous, electric or even gas-powered, rely more on downloaded services and compute resources to run them. Complexity is increasing in terms of data, yet car manufacturers want to simplify their networks by reducing the number of ECUs and software vendors.

Ethernovia and Marvell aim to help solve that problem.

“Companies like Tesla, Rivian—all these electric-vehicle companies—they started with a clean sheet of paper and developed very sophisticated automotive architectures, where the content is going to be much higher than a traditional architecture,” Nigel Alvares, VP of global marketing for Marvell, told EE Times. “That’s the opportunity going forward as more of these vehicles are optimized for the software-defined era.”

A car today may have 200 different software suppliers.

“The bottleneck in making cars fast enough has to do with that,” Ethernovia CEO Ramin Shirani told EE Times. “That’s why Tesla is so far ahead. It starts with a consolidated network on a unified operating system with the consolidation of software. None of that is possible without the network in the car.”

Volkswagen

Incumbent car OEMs like Volkswagen are starting to adopt zonal architectures. Together with Chinese EV maker Xpeng, Volkswagen in April introduced the China Electrical Architecture. With the zonal structure, Volkswagen estimates that the number of ECUs in a car can be reduced by up to 30%. Volkswagen expects the new network to be in production in its vehicles in China by 2026.

TechInsights expects there will be about 2.2 billion automotive Ethernet ports fitted to light-duty vehicles in 2030—equating to more than 20 per vehicle on average. The growth rate from 2025 to 2030 will be over 20% per year, according to the market research firm.

“We’re in the early innings,” Alvares said. “Maybe like 20% of vehicles, if that, have Ethernet.”

Marvell is supplying Ethernet chips for prototypes to some customers, according to Alvares.

“The sensor bridge is a hot area right now where people want to take their cameras and get them on the Ethernet backbone,” he said. “Marvell is the first company to do that Ethernet bridge for sensors.”

In addition to Ethernovia and Marvell, chipmakers like NXP Semiconductors, Texas Instruments, Broadcom and Microchip Technology have entered the car Ethernet business.

Ethernovia’s adoption of 7-nm chip tech from TSMC will give the startup company an edge over the competition in power consumption and heat dissipation, according to Riches.

“Smaller geometry means smaller power,” Mash said. “But it also gives us a path to integration. As we move forward, when we have our packet processors and other devices, being in a smaller geometry allows us to integrate a lot more technology into a single device.”