![]()

Wide bandgap semiconductors have taken both power electronics and high frequency circuits by storm, replacing so many applications that were previously dominated by silicon-based devices, e.g., LDMOS HPAs in base stations, IGBTs in high voltage DC/DC conversion etc. Specifically within power electronics, it is no secret that certain applications are demanding power dense solutions that operate at high switching frequencies to minimize switching losses. From traction inverters, onboard chargers, and high voltage DC-DC converters in EVs to uninterruptible power supplies (UPSs) and solar power converters in industrial/commercial applications; WBG semiconductors have carved out an extensive niche for many next generation electronics.

The SiC substrate has established itself for EV and some industrial applications. However, a bit more recently GaN has surfaced as a strong option for many overlapping applications. Understanding the major differences between these substrates in the context of high power circuits and their respective manufacturing considerations might shed light on the future of these two popular compound semiconductors.

WBG benefits

WBG materials are inherently able to operate at higher switching frequencies and with higher electric fields than the conventional Si substrate. When a semiconductor is heated up, its resistance tends to go down due to thermally excited carriers that are more abundant at higher temperatures, causing conduction. Higher bandgap semiconductors will require higher temperatures (more energy) to excite electrons across the bandgap from the valence band to the conduction band. This translates directly to more power handling capabilities and higher device efficiencies.

This can be seen in Table 1 where SiC and GaN exhibit much higher breakdown electric field, electron mobility, saturation velocity, and thermal conductivity than Si—all factors that enhance switching frequency and power density. However, high switching frequencies will lead to more losses and a lower efficiency FET, this is where optimizing the power device figure of merit (FoM) [Rds(on) x Qg], or optimizing the channel resistance and gate charge for lower conduction and switching losses, is critical.

Properties | Si | SiC | GaN |

Band Gap (eV) | 1.12 | 3.3 | 3.44 |

Critical Breakdown Electric Field (V/cm) x106 | 0.3 | 2 to 4 | 3.3 |

Electron Mobility (cm2/Vs) | 1000 to 1400 | 650 | 1500 to 2000 |

Saturation Velocity (cm/s) x107 | 1 | 2 | 2.2 |

Thermal Conductivity (W/cm K) | 1.5 | 4.9 | 1.3 to 2.2 |

Table 1 Properties of Si, SiC, and GaN.

Generally, GaN FETs max out at around 650-V with power applications around 10 kW while 750-V and 1200-V SiC FETs are not unusual and applications can range from 1 kW up to the megawatts (Figure 1). SiC’s excellent thermal conductivity allows for similar power ratings in significantly smaller packages. However, GaN devices are able to switch faster (note the significantly higher electron mobility) which, in turn, can translate to a higher dV/dt, potentially allowing for more converter efficiency.

![]()

Figure 1: Power versus frequency plot for various power devices. Source: Texas Instruments

Manufacturing considerations

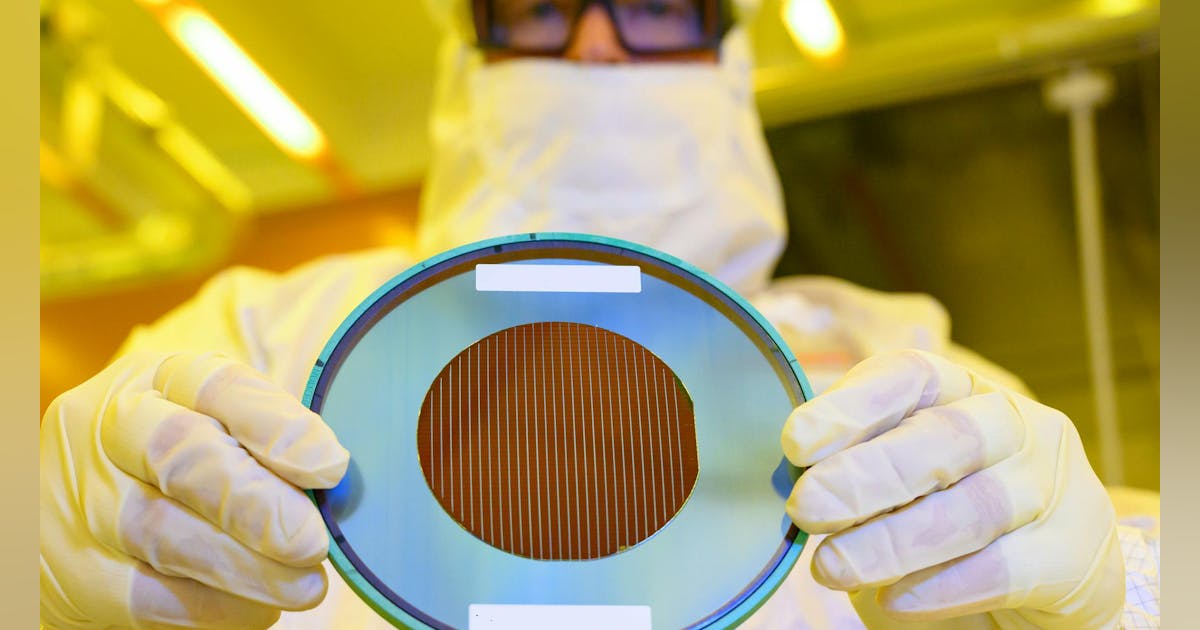

SiC, the recent golden child of power electronics, gained massive traction after Tesla’s announcement using exclusively SiC in the Model 3 back in March of last year. Since SiC MOSFETs were commercialized by Cree in 2010, the demand for SiC has steadily ramped up with key players taking advantage of available tax credits from the CHIPS act to grow operations and drive down the cost per wafer. Wolfspeed (formerly Cree), for instance, recently invested a total of $5 billion in a new production facility, the John Palmour (JP) manufacturing center to develop 200 mm (~8-inch) wafers.

However, it isn’t that simple: getting a foothold in SiC fabrication requires expensive equipment that is exclusively used for SiC. SiC boules are grown at temperatures in excess of 2700℃ at a rate at least 200 times slower than Si, which requires a large amount of energy. GaN on the other hand can largely use the same equipment as Si semiconductor processing where GaN epitaxial wafers can be grown on its respective substrate (often Si, SiC, or sapphire) at a temperature of 1000 to 1200℃—less than half that of SiC. SiC wafers are also nearly 50% thinner than Si wafers (up to 500 μm), leading to a fairly brittle material that is prone to cracking and chipping—another quality that requires specialized processing equipment.

According to Gregg Lowe, CEO at Wolfspeed, 6-inch SiC wafers cost ~$3,000 in 2018, a cost that has been trimmed down to ~$850 for a 7-inch wafer just 6 years later in 2024. And, as SiC power devices continue to mature, costs per wafer will continue to go down. A major leap in optimizing costs are growing wafer sizes and increasing the number of devices per wafer. For GaN-on-Si, this is relatively simple, larger diameter fabs can produce thousands of 8-inch wafers per week with excellent line yields (98%) afforded by CMOS process control. However, similar economies of scale can be applied to SiC wafer production as companies now advance toward 8-inch wafers where just ten years ago, mass production of 150 mm (~6-inch) wafers were really just on the horizon. And, while the SiC devices themselves may be more expensive than Si and GaN counterparts, the fact is, far less power devices are required to maintain the same performance. On the system level, this means less gate drivers, magnetics, and other peripherals devices that might otherwise be used in an Si-based design.

GaN moving beyond 700 V

Because of its excellent high frequency characteristics, GaN has already established itself as a suitable III-V semiconductor for high frequency circuits such as MMICs, hybrid microwave circuits, etc., along with other compound semiconductors such as gallium arsenide (GaAs) and indium phosphide (InP). GaN is particularly relevant for high power amplifiers (HPAs) in the transmit signal chain. Many of the GaN foundry services currently available generally address high frequency applications with GaN-on-SiC however, more recently, foundries are shifting their focus towards GaN-on-Si for both RF and power applications. Table 2 highlights some of the GaN process technologies for different companies globally. Note the table does not include all GaN foundries such as Global Foundries or UMC which will likely be major contenders in Gan-on-Si technologies.

| Company name | Foundry location | Technology name | Substrate | Wafer Size | Gate length | Cutoff frequency | Power Density | Wafer thickness | Breakdown voltage |

| Wolfspeed RF business (now MACOM) | US | G28V5, G28V4, G40V4, G28V3, G50V3, G50V3, G50V4 | SiC | – | 0.15 µm, 0.25 µm, 0.4 µm | Up to 40 GHz | Up to 8.5 W/mm | Up to 100 um | > 84 V, >120 V, >150 V |

| HRL Laboratories | US | T3 | SiC | – | 40 nm | Up to 150 GHz | – | – | > 50 V |

| NXP | US | – | SiC | 6 inches | – | – | – | – | – |

| MACOM/ OMMIC | US | GSiC140 | SiC | – | 140 nm | Up to 30 GHz | 5.5 W/mm | – | > 70 V |

| Northrop Grumman | US | GAN20 | SiC or Si | 4 inches | 0.2 µm | Up to 200 GHz | – | 100um | – |

| BAE systems | US | 0.14 µm GaN, 0.18 µm GaN | SiC | 4 to 6 inches | 0.14 µm, 0.18 µm | Up to 155 GHz | – | 55 and 100 um | > 80 V |

| Qorvo | US | QGaN25, QGaN15, QGaN25HV, QGaN50 | SiC | 4 inch | – | Up to 50 GHz | – | – | <28V, <40V, < 50 V, <65 V |

| WIN Semiconductors | Taiwan | NP12-01, NP25-20 | SiC | 4 inches | 0.12 µm, 025 µm | Up to 50 GHz | 4 W/mm, 10 W/mm | – | – |

| TSMC | Taiwan | – | Si | 6 inches | – | – | – | – | – |

| X-FAB | Germany and US | – | Si | 6 to 8 inches | 0.35 µm | – | – | – | – |

| Infineon/GaN systems | Austria and Malaysia | Gen1 (CoolGaN), Gen2 | Si | Up to 8 inches | – | – | – | – | – |

| UMS | Germany | GH15, GH25 | SiC | 4 inches | 0.15 µm, 0.25 µm | Up to 35 GHz | Up to 4.5 W/mm | 70 to 100 um | > 70 V, > 100 V |

| GCS | China | 0.15 µm, 0.25µm, 0.4µm, 0.5µm GaN HEMT Processes | Si and SiC | 4 to 6 inches | 0.15 µm, 0.25µm, 0.4µm, and 0.5µm | Up to 23 GHz | Up to 13.5 W/mm | – | > 150 V, > 200 V |

| Innoscience | China | – | Si | Up to 8 inches | 0.5 µm | – | – | – | – |

Table 2: Select GaN foundries and specifications on their technology.

SiC and GaN serve very distinct parts of the power spectrum, however, can higher voltage GaN devices be designed to creep up the spectrum and contend with SiC? The GaN pHEMTs that dominate GaN fabrication have breakdown voltages (~0.6 to 1.5 MV/cm) that generally cap out at around 650 V due to the inherent limits of its critical breakdown field [1-2]. Methods of reaching the intrinsic limits of 3 MV/cm are being explored in research in order to improve the breakdown characteristics of GaN devices.

More and more manufacturers are showcasing their 700-V GaN solutions. There have been talks of a 1200 V GaN FET; Transphorm released a virtual design of their 1200 V GaN-on-Sapphire FET in May of last year. Outside of this much of the talk of GaN moving up the power spectrum has remained in the R&D space. 1200-V Vertical GaN (GaN-on-GaN) transistors are also being researched by NexGen Power Systems with their Fin-JFET technology [3], a success that has allowed the company to receive funding from the US department of energy (DOE) to develop GaN-based electric drive systems. However, many of these solutions are not GaN-on-Si.

GaN-on-Si simply might have the major advantage of bandwagoning on the silicon semiconductor industry’s already established technology maturity, however, using the Si substrate comes with some design challenges. There are two major constraints: a large lattice mismatch and an even larger thermal mismatch between the GaN epitaxial layer and the host substrate causing tensile and compressive strains on the two substrates resulting in dislocations and higher defect densities (Table 3). Other substrates are being researched to overcome this issue, Qromis, for instance, has recently engineered a ceramic poly-aluminum nitride (AlN) layer that is CMOS fab compatible and CTE-matched to GaN.

Lattice mismatch | Thermal mismatch | |

GaN and Si | 16-17% | 116% |

GaN and Sapphire | 16% | -25% |

GaN and SiC | 3.5% | +33% |

Table 3 Lattice and thermal mismatch between GaN and Si, sapphire, and SiC. Source: [4]

Access to Gallium

While GaN wafers are generally more convenient to manufacture, they do require a precious metal that is, by nature, in limited supply. There was strain on the gallium supply with the 2019 tariffs on Chinese imports ratcheted up significantly causing a 300% increase in gallium metal imported from China compared to 2018 where the surplus was likely stockpiled. China’s restrictions on gallium exports in August of last year further diminished the already small amount imported from China. The bans could have potentially signaled a problem as China produces nearly 98% of the world’s low-purity gallium.

However, the issue has not truly disrupted gallium-based wafer production (GaAs or GaN), largely due to the stockpiling and shifting to other sources for the rare metal (Table 4). Many countries now have the incentive to scale up the operations that, over a decade ago, were shut down due to China’s overproduction. Still, this may be something to consider if China further restricts its exports in the short term. It may also be important to note that since GaN wafers are produced by growing GaN crystals on top of a variety of substrates, relatively small amounts of gallium are used per device as compared to GaAs pHEMTs that are grown on semi-insulating GaAs wafers. So, while this may have been something to consider given the recent history of restricted gallium supplies, it has not really impacted GaN production and likely won’t in the future.

U.S. imports for consumption of unwrought gallium and gallium powders (2017 to 2021) | |||||

2017 | 2018 | 2019 | 2020 | 2021 | |

Country/Locality | Quantity (kg) | ||||

China | 4,860 | 19,300 | 494 | 43 | 648 |

Taiwan | — | — | 500 | 1,000 | 500 |

Hong Kong | 2,000 | 5,400 | 1,000 | — | — |

Korea, Republic of | 1,140 | 1,280 | 11 | — | — |

Singapore | 525 | — | — | — | 689 |

Japan | 540 | 1,070 | 400 | 512 | 4,510 |

United Kingdom | 6,180 | 50 | 428 | — | 15 |

Germany | — | 1,240 | 1,750 | 2,630 | 1,140 |

France | 1,980 | 417 | 109 | 163 | — |

Belgium | — | — | 47 | — | 86 |

Denmark | 28 | — | — | — | — |

Canada | — | — | — | 84 | 792 |

Estonia | — | 140 | — | — | — |

Russia | 1,360 | 507 | 1,000 | — | 500 |

Ukraine | 1,600 | 2,560 | — | — | — |

South Africa | 23 | 23 | — | — | — |

Total | 20,200 | 32,000 | 5,740 | 4,430 | 8,890 |

Table 4: US imports of unrefined gallium by country or locality according to USGS [5].

SiC and GaN

As it stands SiC and GaN dominate distinct parts of the power spectrum and therefore distinct applications with only some overlap. However, if GaN FETs can successfully increase in drain-source voltage without stifling its current massive manufacturing advantage, it may very well break out of its current place largely in consumer electronics (e.g., USB chargers, AC adapters, etc.) into higher power applications that SiC power devices currently dominate. SiC manufacturing has not stagnated though, and steady progress is being made in wafer size and yield to drive down the cost of SiC.

Aalyia Shaukat, associate editor at EDN, has worked in the design publishing industry for seven years. She holds a Bachelor’s degree in electrical engineering, and has published works in major EE journals.

Related Content

- Silicon carbide (SiC) counterviews at APEC 2024

- APEC 2023: SiC moving into mainstream, cost major barrier

- GaN Power Devices: Challenges and Improvements

- Selecting GaN or SiC devices with a Focus on Reliability

References

- Tian Z, Ji X, Yang D, Liu P. Research Progress in Breakdown Enhancement for GaN-Based High-Electron-Mobility Transistors. Electronics. 2023; 12(21):4435. https://doi.org/10.3390/electronics12214435

- Exploring an Approach toward the Intrinsic Limits of GaN Electronics. Sheng Jiang, Yuefei Cai, Peng Feng, Shuoheng Shen, Xuanming Zhao, Peter Fletcher, Volkan Esendag, Kean-Boon Lee, and Tao Wang. ACS Applied Materials & Interfaces 2020 12 (11), 12949-12954. DOI: 10.1021/acsami.9b19697

- R. Zhang et al., “Vertical GaN Fin JFET: A Power Device with Short Circuit Robustness at Avalanche Breakdown Voltage,” 2022 IEEE International Reliability Physics Symposium (IRPS), Dallas, TX, USA, 2022, pp. 1-8, doi: 10.1109/IRPS48227.2022.9764569.

- Kaminski, Nando, and Oliver Hilt. “SiC and GaN Devices – Wide Bandgap Is Not All the Same.” IET Circuits, Devices & Systems, vol. 8, no. 3, 2014, pp. 227-236. https://doi.org/10.1049/iet-cds.2013.0223.

- “Gallium Statistics and Information.” U.S. Geological Survey, [last modified August 29, 2023], usgs.gov/centers/national-minerals-information-center/gallium-statistics-and-information. [accessed on 2023-10-26].

googletag.cmd.push(function() { googletag.display(‘div-gpt-ad-native’); });

–>

The post GaN vs SiC: A look at two popular WBG semiconductors in power appeared first on EDN.